The Signal Series

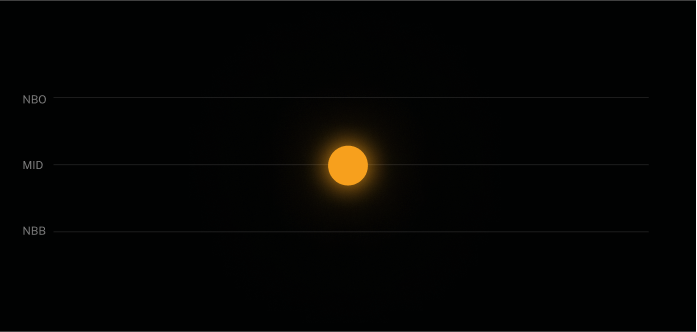

These order types use the Signal and are designed to offer enhanced price protection. Their behavior is designed to function differently when the Signal is on compared to when the Signal is off.

The Retail Series

These order types are designed to bring high-quality trading at the midpoint or better to retail as part of our Retail Program.

Retail Order

This is a D-Peg or Midpoint Peg order that is priced to trade at the midpoint on entry. Must represent the trading interest of a retail investor.

- Can trade against any order, including RLP orders

Retail Liquidity Provider (RLP)

This is a variation of M-Peg that passively rests on the BlockWayFi book for incoming retail orders.

- Dark

- Only executes at the midpoint

- Only trades against Retail orders

The Standard Series

These are our traditional order types.

Crypto Trading by Strategy

BlockWayFi offers order types that fit into a range of trading strategies.